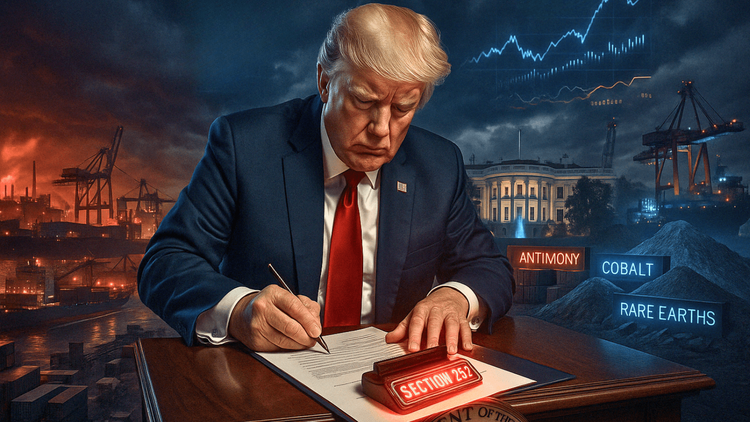

Trump Launches Full-Scale Tariff Probe Into U.S. Critical Mineral Imports

Trump’s sweeping Section 232 probe on critical mineral imports aims to curb U.S. dependence on China while unlocking massive opportunity for North American producers.

In a sweeping escalation of his economic strategy, President Donald Trump has launched a Section 232 national security investigation into all U.S. critical mineral imports, a move poised to shake global supply chains and rattle international trade partners, particularly China. Announced on April 15, 2025, this decision represents the administration's most aggressive stance yet in securing America’s resource independence—a pivot many say is long overdue.

The order, signed at the White House, grants Commerce Secretary Howard Lutnick authority to evaluate the national security implications of America’s dependency on foreign-sourced critical minerals. The same legal tool—Section 232 of the Trade Expansion Act of 1962—was previously used by Trump during his first term to impose global tariffs on steel and aluminum. Now, it’s being wielded again to assess the vulnerability of America's supply chains for everything from antimony and cobalt to lithium, nickel, and rare earths.

This probe marks a clear warning to Beijing. It follows a string of retaliatory actions by China, which recently slapped export controls on rare earths and antimony—two vital ingredients in electric vehicles, advanced electronics, and defense applications. China's dominance in processing these minerals, and its willingness to weaponize that power, has reignited concerns in Washington about the U.S. economy’s Achilles’ heel: foreign dependency on the raw materials of modern technology.

Mineral Monopoly: The China Factor

At the heart of this new trade offensive is a strategic rivalry between the U.S. and China. While America boasts abundant mineral deposits, it has long outsourced the costly and environmentally fraught business of mineral refining. China, on the other hand, has spent decades investing in mining, processing, and controlling key assets across Asia, Africa, and Latin America.

The U.S. currently has only one operational rare earth mine, no cobalt refinery, a single nickel mine without domestic smelting capacity, and a highly limited ability to process lithium. Copper—the metal at the heart of electrification—fares only slightly better, with several mines but just two smelters.

Meanwhile, China has flexed its dominance, recently banning exports of key rare earth magnet materials and placing restrictions on antimony products. These decisions came in the wake of Trump’s February launch of a copper-specific probe and broader tariffs earlier this month under the so-called “Liberation Day” trade reset. Beijing’s message was unmistakable: push too hard, and we’ll push back harder.

The Strategic Importance of Antimony

Among the elements under the microscope, antimony has quietly emerged as one of the most geopolitically significant. Used in everything from flame retardants and solar panels to ammunition primers and semiconductors, antimony is both industrial and militarily essential.

Military Metals Corp. (CSE: MILI, OTCQB: MILIF), an exploration and development company with antimony assets in Nova Scotia and Slovakia, stands to benefit from any tariff-induced realignment. Its West Gore project is especially well positioned, as Canada remains a close U.S. ally under the USMCA trade pact. With China supplying over 50% of global antimony and now imposing restrictions, companies like Military Metals are looking increasingly attractive to investors searching for secure supply chains.

Recent data suggests that antimony prices have surged to $18,000 per ton in Q1 2025—up sharply from prior quarters. That price momentum is directly tied to Beijing’s tightening grip and the growing demand from Western governments seeking to shore up their own production capacity.

A Domestic Advantage: UAMY Steps Forward

For the United States Antimony Corporation (NYSE American: UAMY), this tariff probe could not come at a better time. As North America’s only vertically integrated antimony producer—with operations in Montana, Idaho, Mexico, and Canada—UAMY is poised to become a critical cog in the Pentagon’s supply chain.

UAMY recently secured a $5 million credit line to build up antimony inventory, a prescient move that now puts it ahead of the curve as prices spike. Its Montana and Idaho sites, already producing antimony and precious metals, could be critical to bridging America’s supply gap should tariffs make Chinese imports uneconomical or politically untenable.

With national security cited as the rationale for the probe, UAMY’s defense-facing business model fits perfectly into the Trump administration’s reshoring narrative. In a world where every mineral counts, UAMY isn’t just a mining company—it’s a national asset.

The Rare Earth Renaissance: USA Rare Earth and MP Materials

Perhaps no company symbolizes America’s rare earth ambitions more than USA Rare Earth Inc. (NASDAQ: USAR). Its Round Top project in Texas is one of the largest deposits of heavy rare earth elements in the U.S., including critical magnets like dysprosium and terbium.

As China clamps down on magnet-related exports, the economic case for domestic production has never been stronger. With Round Top moving closer to development, USA Rare Earth is banking on its fully integrated vision—from mine to magnet—to attract both investors and federal support. Government backing could come in the form of tax incentives, loan guarantees, or even strategic partnerships, mirroring Canada’s recent $50 million investment in its own critical minerals industry.

Meanwhile, MP Materials Corp. (NYSE: MP), which operates the Mountain Pass mine in California, remains the sole U.S. producer of rare earth oxides. Neodymium and praseodymium, the core materials used in EV motors and wind turbines, are in short supply globally. MP is already processing these materials domestically, but tariffs on Chinese imports could significantly boost demand for its products—and its share price.

MP also benefits from recent price surges. Neodymium is up 15% in Q1 2025, according to recent market data, and investors are once again paying attention to America’s need for resilient rare earth supply lines.

The Politics of Protectionism

While Trump’s move may spark global criticism, it’s increasingly aligned with public sentiment. The pandemic and war in Ukraine exposed just how fragile global supply chains really are. Now, with tensions with China rising, American voters are backing policies that prioritize domestic production—even at a higher cost.

This isn’t just economic policy—it’s national security doctrine. If rare earths are the oil of the 21st century, Trump is making sure America doesn’t get caught with an empty tank. The tariff probe isn't just about numbers or trade imbalances. It's about who controls the building blocks of the modern world—chips, batteries, missiles, satellites—and ensuring those controls are not in the hands of strategic rivals.

Winners, Losers, and What Comes Next

The winners of this probe are clear: domestic producers, North American allies, and exploration companies sitting on critical mineral deposits. The losers? Chinese exporters, global traders banking on the status quo, and U.S. manufacturers who now face rising input costs.

Yet the story is far from over. Commerce Secretary Howard Lutnick now begins the detailed process of analyzing market data, evaluating industry dependence, and determining which imports pose a risk to national security. It could take months before tariffs are imposed—if they are imposed at all. But even the threat is enough to drive market volatility and strategic planning.

Expect further consolidation in the critical minerals space. Expect more money flowing into U.S. and Canadian projects. Expect a flood of lobbying from industries on both sides. And most of all, expect a renewed focus on how minerals shape power in a world increasingly defined by scarcity, security, and technological supremacy.

Conclusion

Trump’s latest trade offensive is more than a headline—it’s a blueprint for reshaping the world’s mineral future. By targeting critical mineral imports under the national security banner, the administration is laying the groundwork for a new era of resource sovereignty. Companies like Military Metals, UAMY, USA Rare Earth, and MP Materials now find themselves in the geopolitical spotlight, backed by market forces, policy tailwinds, and a rising sense of urgency to break free from foreign dependence. Whether you’re an investor, policymaker, or industrial player—this is the moment to pay attention. The next chapter of global trade is being written in the rocks beneath our feet.

_Disclaimer The author may own shares in Military Metals Corp or any other stocks mentioned in this article. The author may choose to buy or sell shares at any time without notice. Although efforts have been made to ensure the accuracy and reliability of the information presented, readers are encouraged to conduct their own research and seek independent financial advice before making any investment decisions related to the small-cap companies mentioned. This article was written with the assistance of AI to provide information related to these companies.