Hyundai Shifts to High Gear with a Record $21 Billion U.S. Move

Hyundai ramps up its U.S. investment strategy with a bold $21 billion move, countering Trump’s looming tariff threats and strengthening its American supply chain.

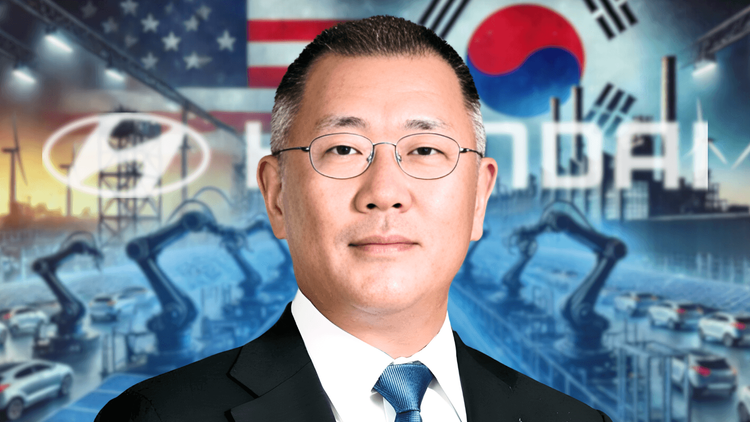

South Korea’s Hyundai Motor Group has committed to a massive $21 billion investment in the United States, marking its largest commitment to American manufacturing to date. The announcement, made by Chairman Euisun Chung in the White House alongside President Donald Trump and Louisiana Governor Jeff Landry, comes at a critical time as the U.S. administration signals a tougher stance on foreign imports.

At the core of Hyundai’s investment is a $5.8 billion steel plant in Louisiana, expected to produce 2.7 million metric tons of steel annually and create nearly 1,500 jobs. This move is likely aimed at securing Hyundai’s supply chain against potential disruptions from heightened tariffs and geopolitical tensions.

Expanding U.S. Manufacturing Footprint

In addition to the Louisiana steel plant, Hyundai is also advancing its automotive manufacturing presence with a $7.6 billion car and battery factory in Georgia. This facility will be Hyundai’s third in the United States, complementing existing plants in Alabama and Georgia, where its affiliate Kia also operates. Once fully operational, the new plant is expected to produce 300,000 vehicles per year, pushing Hyundai’s total U.S. production capacity to 1 million vehicles annually.

Hyundai’s aggressive expansion in the U.S. signals a strategic pivot toward localization, reducing its reliance on overseas production while strengthening its foothold in one of its most critical markets. The company’s stock surged 3.3% in Asia following the announcement, underscoring investor confidence in Hyundai’s long-term strategy.

Trump’s Tariff Crackdown and Hyundai’s Calculated Response

Hyundai’s move comes as the Trump administration threatens a sweeping tariff overhaul aimed at countries with large trade surpluses with the U.S., including South Korea. Trump’s policy, set to take effect on April 2, could see steep reciprocal tariffs imposed on nations exporting more to the U.S. than they import.

Hyundai’s CEO, Jose Munoz, has been vocal about the company’s proactive approach to mitigating these risks. By deepening its U.S. investment and shifting more production stateside, Hyundai positions itself to sidestep potential tariffs that could otherwise dent its competitiveness in the American market.

Trump has previously imposed a 25% tariff on steel and aluminum imports and a 20% tariff on Chinese goods. The White House hailed Hyundai’s investment as a testament to Trump’s economic agenda, reinforcing the administration’s push for reshoring manufacturing jobs.

Hyundai Joins the Wave of Asian Investments in the U.S.

Hyundai is not alone in bolstering its U.S. presence. Other major Asian corporations have made similar commitments in recent months. Japanese automaker Honda announced a $300 million investment to expand EV and hybrid production in Ohio. Taiwan Semiconductor Manufacturing Co. (TSMC) committed a staggering $100 billion to expand its semiconductor operations in Arizona, a move aimed at securing critical chip production within U.S. borders.

Foxconn, the world’s largest electronics contract manufacturer, has also unveiled plans to invest over $140 million in Texas to expand AI server capacity. Meanwhile, Japanese tech giant SoftBank partnered with OpenAI and Oracle in a long-term plan to invest $500 billion in American AI infrastructure.

The Bigger Picture: U.S. Protectionism and Global Supply Chains

Hyundai’s investment underscores a broader shift in global supply chains as multinational corporations seek to hedge against trade restrictions and economic uncertainty. The Trump administration’s aggressive stance on trade, combined with growing geopolitical tensions, has accelerated a trend toward onshoring and regionalized production.

For Hyundai, the stakes are high. As one of the top-selling carmakers in the U.S. and the leading EV manufacturer after Tesla, maintaining market stability is crucial. By betting big on American manufacturing, Hyundai is not only safeguarding its future but also ensuring that it remains a dominant force in the evolving U.S. auto industry.

Conclusion

Hyundai’s $21 billion U.S. investment is more than just a response to Trump’s tariff threats—it’s a strategic move to future-proof its operations in a shifting economic landscape. As global trade dynamics continue to evolve, Hyundai’s decision to double down on American manufacturing could set a precedent for other foreign companies navigating the challenges of an increasingly protectionist U.S. trade policy.