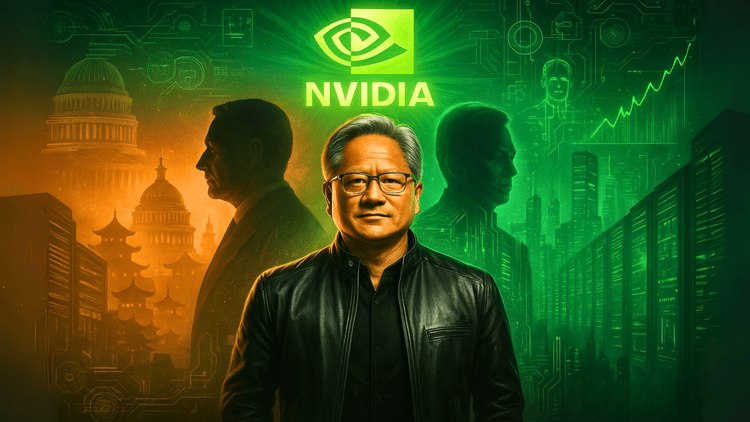

Dan Ives: Jensen Huang Is "10% Politician, 90% CEO" and Nvidia’s Secret Weapon

Wall Street may be cautious, but Dan Ives argues Nvidia’s dominance in AI chips and global tech makes its upside far greater than the market realizes.

Nvidia has once again delivered record earnings, beating expectations on both revenue and profit. Yet despite the strong results, shares dipped slightly, leaving investors debating whether the run-up in Nvidia’s valuation has peaked. Dan Ives, managing director and senior equity research analyst at Wedbush Securities, believes Wall Street is missing the bigger picture. In his view, Nvidia is only in the early stages of an acceleration that could redefine the next decade of technology.

A Data Center Miss That Doesn’t Change the Story

While Nvidia’s results were broadly impressive, its data center revenue came in below some analyst expectations. For skeptics, that was a red flag. But Ives argues that this is transitional noise. He insists the real story lies in what’s coming next, especially as data center growth reaccelerates over the next several quarters. According to Ives, Wall Street is still underestimating Nvidia’s growth trajectory by 25 to 30 percent, setting up the stock for another round of bullish momentum.

One of the biggest questions hanging over Nvidia is China. The company reported no sales of its H20 chips to Chinese customers this past quarter due to U.S. export restrictions. Competition within China is intensifying, and regulatory uncertainty continues to cloud the outlook. But Ives maintains that China will remain a key part of Nvidia’s future, calling it a potential fifty-billion-dollar market as soon as next year. He views the current pause as temporary, arguing that a “green light” for renewed sales will arrive within the next 45 to 60 days. If that happens, it could be a game changer for Nvidia’s revenue stream.