“BE COOL!”: Trump Brushes Off Bear Market Fears

Markets wobble, tariffs fly, and Trump tells investors to “BE COOL!” as global tensions shake Wall Street and trigger talk of stagflation.

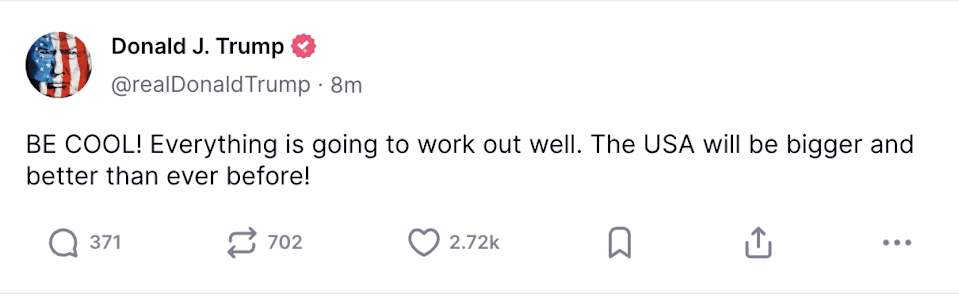

As markets reeled from a wave of retaliatory tariffs and investor unease, President Donald Trump took to Truth Social with a characteristically blunt message: “BE COOL! Everything is going to work out well. The USA will be bigger and better than ever before!”

It was a call for calm amidst chaos. Wall Street has been shaken by the administration’s sweeping tariff package — a reciprocal policy affecting over 185 countries. After weeks of speculation and diplomatic tension, the tariffs are now official, and global markets have responded with a violent churn.

(Source: Truth Social)

(Source: Truth Social)

On Tuesday, the S&P 500 suffered one of its worst two-day drops in years, flirting with bear market territory. Though Wednesday brought a modest rebound, the underlying tone remains anxious. The Dow rose 0.48%, the Nasdaq jumped 1.70%, and the S&P 500 recovered slightly with a 0.85% gain. But these numbers only tell part of the story.

Tariffs Ignite Global Trade War

At the heart of the market turbulence is the Trump administration's decision to impose massive new duties — including a staggering 104% tariff on Chinese goods. In response, China announced retaliatory tariffs of up to 84% on U.S. imports. This tit-for-tat escalation has sent tremors through the global economy and reignited fears of a full-blown trade war.

For American businesses, especially those with exposure to international supply chains, the timing couldn't be worse. Corporate earnings are under pressure, costs are rising, and forward guidance from some of Wall Street’s biggest names is sounding increasingly cautious.

President Trump, however, has framed the move as a necessary step toward reclaiming American economic independence. “We’ve been taken advantage of for decades,” he said during an event at the White House on Tuesday. “It’s time for fair trade — not free trade.”

The Treasury Market Screams Warning Signs

Perhaps the most unsettling indicator of market unease is coming from the Treasury market. Over the past three days, the 10-year yield has experienced its sharpest jump since December 2001. What began as a bond rally quickly reversed course as investors scrambled to reprice risk in a rapidly shifting landscape.

This type of volatility in Treasuries often serves as a flashing red light for economic instability. Analysts now warn that a prolonged standoff could push the U.S. economy into a period of stagflation — the dangerous mix of stagnant growth, persistent inflation, and rising unemployment.

LPL Financial echoed those concerns in a research note released Monday, stating, “While it’s too early to fully understand the economic ramifications of a potential trade war, the tug-of-war between slowing growth and higher inflation will likely continue to add volatility.”

A Divided Wall Street Searches for Clarity

Amid the turmoil, investors are divided. Some see opportunity in the chaos. In a client note, Goldman Sachs partner John Flood suggested that longer-term investors are preparing to start buying if the S&P 500 dips to around 5,000 — with more aggressive buying expected in the mid-4,000s. “From my conversations with longer-duration investors, it feels like they will start scale buying the S&P 500 at 5,000,” Flood wrote.

Others remain skeptical, pointing out that markets are reacting not just to economic fundamentals but also to unpredictable rhetoric and erratic policymaking.

Michael Kantrowitz, Chief Investment Strategist at Piper Sandler, argues that a change in tone from the administration — not just numbers — will be needed to stabilize investor sentiment. “Ultimately, the catalyst needs to be a change in the tone of rhetoric,” he said in an interview with Yahoo Finance. “A lot of historical analogs may or may not be as useful today because of this really unprecedented situation.”

Labor Market Holds Steady — For Now

Ironically, the U.S. labor market, often a canary in the coal mine for broader economic stress, has held up relatively well in the face of these escalating trade tensions. Unemployment remains low, and hiring data from the past quarter was stronger than expected.

Yet, that resilience may not last. As tariffs take effect, costs for both businesses and consumers are expected to rise, which could eat into margins, slow down hiring, and eventually dampen consumer spending.

“If things continue to escalate and the duration of this persists, then we’ll start to see the data get worse,” warned Kantrowitz. “That could lead to people focusing on a more ominous outlook for the economy.”

A Recession or a Reset?

The bigger question looming over all of this is whether the U.S. is heading into a self-inflicted recession — or whether this is simply a short-term correction on the way to a more self-sufficient economy. Trump’s supporters argue the latter, saying that the U.S. must endure some short-term pain in order to secure long-term economic sovereignty.

“Short-term volatility is a small price to pay for long-term greatness,” one administration official told Yahoo Finance, speaking on condition of anonymity. “We are reshaping the global order in our favor.”

Critics, however, believe the risk is far too high. They point to strained diplomatic relations, rising consumer prices, and growing uncertainty among small businesses and manufacturers as signs that the policy may backfire.

Elon Musk and the Department of Government Efficiency

One wildcard in the mix is the newly formed Department of Government Efficiency (DOGE), led by tech mogul Elon Musk. The department recently proposed sweeping cuts to government spending — including a controversial plan to trim the federal workforce by 20%.

Some analysts fear this initiative could add another layer of instability to an already fragile system. Others view it as a necessary component of the Trump administration’s broader push to streamline governance and reduce the deficit.

Musk has remained mostly silent amid the recent market turbulence, but sources say his team is working on a “Resilience Blueprint” that aims to keep core government services functioning even in the event of prolonged economic stress.

Trump Doubles Down, Calls It a ‘Buying Opportunity’

In a follow-up post on Truth Social, Trump reiterated his optimism — and pivoted toward opportunity. “Markets go up, they go down. Right now, they’re offering Americans a tremendous chance to BUY!” he wrote.

It’s a sentiment echoed by many contrarian investors, who believe that fear-driven sell-offs can create attractive entry points for those willing to weather the storm. But whether this optimism holds in the face of more retaliatory tariffs and geopolitical backlash remains to be seen.

Conclusion

America is once again standing at a crossroads, and this time it’s not just about politics — it’s about the very foundation of the global economy. With tariffs reshaping trade routes and rattling markets, investors are scrambling for answers. Trump says, “Be cool.” But for millions of Americans watching their portfolios shrink, that's easier said than done. Whether this is the beginning of a broader economic reset or a descent into stagflation will depend not just on numbers, but on how the rhetoric and retaliations evolve in the weeks ahead.