The AI Gold Rush Hasn’t Gone Full Bubble, Says Goldman Sachs

Goldman Sachs’ Peter Oppenheimer says today’s AI-fueled rally may resemble past bubbles, but strong fundamentals keep it on solid ground—for now.

The market may feel euphoric, but Goldman Sachs insists we’re not living through a bubble—at least not yet. Investors might be tempted to draw comparisons to the late 1990s or the 2021 tech surge, but Peter Oppenheimer, Goldman’s chief global equity strategist, argues the fundamentals tell a different story. His latest report paints a picture of a market walking a fine line between exuberance and realism, with artificial intelligence sitting squarely at the center of it all.

Echoes of the Past, But Not a Repeat

Oppenheimer acknowledges that some patterns mirror previous bubbles. Valuations are rising, leadership is narrowing, and capital intensity is creeping higher, particularly in AI. The emergence of vendor financing in the sector feels eerily reminiscent of the dot-com days when companies burned cash to chase growth. Yet, this time, the balance sheets look stronger, the earnings more tangible, and the innovation far more grounded in productivity than hype.

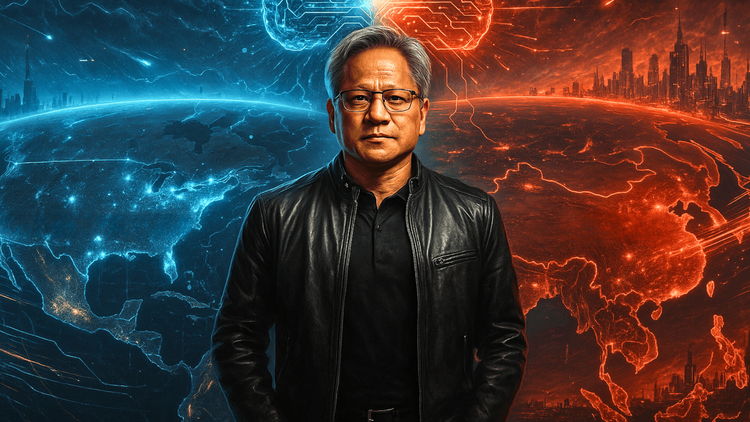

In the late 1990s, the market swelled on expectations rather than results. Today’s AI-driven rally, powered by heavyweights like Nvidia, Microsoft, and Google, is different. These companies are not speculative startups—they’re global titans generating billions in free cash flow. That distinction, Goldman argues, is what’s keeping this market from crossing into true bubble territory.