Record-Setting Q3: American Aires Sees 61% Increase in Sales and Order Volume

American Aires hits record-breaking Q3 performance, achieving unprecedented order volume, sales, and an improved gross profit margin.

American Aires Inc. (CSE: WIFI | OTCQB: AAIRF) has made headlines with its impressive Q3/2024 financial results, achieving record-high order volume and sales figures, along with a significant improvement in gross profit margin. With a focus on cutting-edge technology designed to protect against electromagnetic field (EMF) radiation, Aires continues to see strong growth, supported by strategic partnerships and marketing initiatives. This article delves into the financial highlights of the quarter, the factors driving the company's success, and what lies ahead for American Aires as it expands its market reach.

Q3/2024 Financial Overview

During Q3/2024, American Aires reported a remarkable 61% year-over-year (YoY) increase in order volume, reaching an all-time company high of $4.92 million. This growth represents a strong indication of the company's expanding market footprint and effective deployment of scaled-up advertising and marketing budgets.

Aires’ reported sales for Q3/2024 increased by 57% YoY, reaching $4.59 million, up from $2.92 million in the same quarter last year. This increase was driven by multiple factors, including partnerships with high-profile athletes, leagues, and a more aggressive marketing strategy. The partnerships with major organizations like the UFC, Canada Basketball, and prominent athletes such as NHL captain John Tavares, NBA star RJ Barrett, and WWE champions have been pivotal in driving both order volume and sales growth.

The gross profit for Q3/2024 also grew significantly, rising by 61% YoY to $2.91 million. The company reported a gross margin of 63%, up from 62% in Q3/2023. This margin improvement reflects the company's efforts to optimize its production and distribution channels, alongside its ability to scale its business efficiently.

Key Drivers of Growth

One of the standout features of American Aires’ strategy in 2024 has been its focus on forging key partnerships with sports organizations and athletes. These collaborations have enabled the company to tap into a broader audience and strengthen its brand presence within both the technology and sports industries. The partnerships are part of a long-term strategy to build Aires into a global and household brand recognized for its EMF protection technology.

The success of Q3 can also be attributed to the company's increased advertising and promotional spend. Aires saw advertising expenses rise by 101% YoY to $2.31 million, and marketing expenses grew by 94% YoY to $1.14 million. These investments were largely targeted at boosting brand awareness and driving sales, particularly ahead of the holiday season, a period when the company expects further growth in demand.

Operational Highlights

To bolster its marketing efforts, American Aires has collaborated with Gray Wolf, a public relations firm. This partnership has helped Aires refine its customer-facing messaging and bring its technology to a wider audience. The result has been a significant uptick in brand awareness and increased sales momentum, particularly within the EMF protection market.

American Aires has consistently innovated its marketing strategies, utilizing both organic and paid channels. The use of compelling content related to its partnerships with sports figures and leagues has allowed the company to maintain a strong connection with its target audience. This combination of innovative marketing and targeted advertising has been a key factor in driving Q3/2024 growth.

Financial Breakdown and Performance Metrics

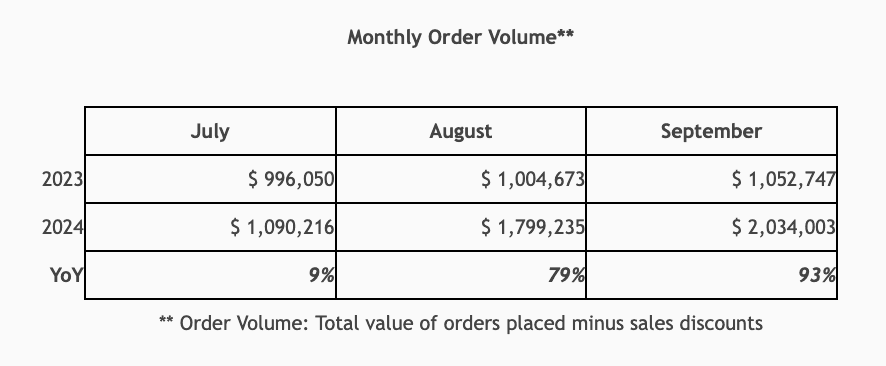

The following table showcases Aires' monthly order volume growth during Q3/2024 compared to the same period in 2023:

As evidenced, the most significant YoY growth occurred in August and September, where order volume grew by 79% and 93%, respectively.

EBITDA Loss and Future Outlook

Despite strong top-line growth, American Aires reported an adjusted EBITDA loss of $1.17 million for Q3/2024, compared to a loss of $0.38 million in the same quarter last year. This loss was attributed to increased marketing and advertising expenditures, which management expects will yield returns in future quarters, particularly as the company moves into the holiday season.

CEO Josh Bruni remains optimistic, noting, "Achieving our highest ever order volume and sales in Q3 is our latest important milestone. That growth confirms our strategy and efforts in Q1 and Q2 were correct." Bruni added that the company's focus is on maintaining growth targets and building Aires into a globally recognized brand.

Challenges and Competitive Landscape

A significant challenge noted by management is the higher advertising rates due to the ongoing US presidential election campaigns. Political campaigning has driven up the cost of media placements, a trend expected to continue into Q4/2024. According to industry forecasts, ad rates could rise by 15-50% during the core six weeks leading into the election. Despite these challenges, Aires has effectively managed its ad spend, ensuring that it maintains strong sales growth.

Looking Ahead: Q4 and Beyond

As American Aires moves into Q4/2024, the company anticipates continued growth in both order volume and sales, driven by holiday shopping trends. The company's increased marketing efforts in Q3/2024 are expected to pay off as customers acquired during the quarter return for the holiday season.

Looking further ahead, American Aires is focused on expanding into new markets and continuing its growth trajectory. The company is already exploring opportunities in international markets, particularly as awareness of EMF radiation risks grows globally.

Conclusion

American Aires' record-breaking Q3/2024 results demonstrate the company's strong growth momentum, driven by strategic partnerships, increased marketing investments, and an innovative approach to brand building. With a focus on protecting consumers from EMF radiation, Aires is well-positioned to continue its growth, both in Q4/2024 and beyond. As the company scales its operations, it will be interesting to see how its partnerships and marketing strategies evolve to sustain this impressive performance.