Poland Approves Plan to Buy 150 Tons of Gold, Targeting Global Top 10

Governor Glapiński’s aggressive accumulation strategy targets 700 tonnes, shielding the Złoty and securing Warsaw a seat at the global financial head table.

For years, the "Gold Club" has been a VIP lounge reserved for the world’s financial old guard, legacies of empire, trade dominance, and banking neutrality. But as of this week, there is a new bouncer at the door, and he speaks Polish.

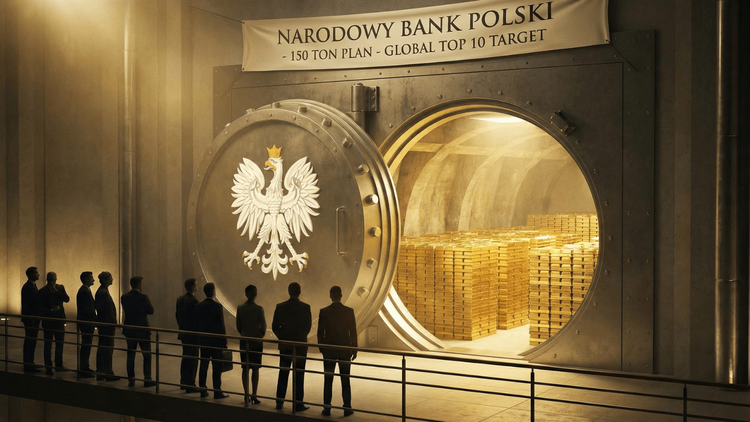

In a decision that effectively redraws the map of European financial power, the National Bank of Poland (NBP) has approved a massive acquisition plan to purchase an additional 150 tonnes of gold. The move is not merely a portfolio adjustment; it is a declaration of sovereign intent that lifts Poland’s bullion target to 700 tonnes, catapulting Warsaw past the Netherlands and into the global top ten of official gold holders.

Governor Adam Glapiński, who has orchestrated Poland’s aggressive accumulation strategy since 2018, made the announcement on Tuesday, January 20, framing the purchase as a critical "trust anchor" for the nation. While other central bankers offer vague platitudes about diversification, Glapiński has been remarkably blunt: in an era of geopolitical tremors, gold is the only asset that doesn't rely on another nation's signature.