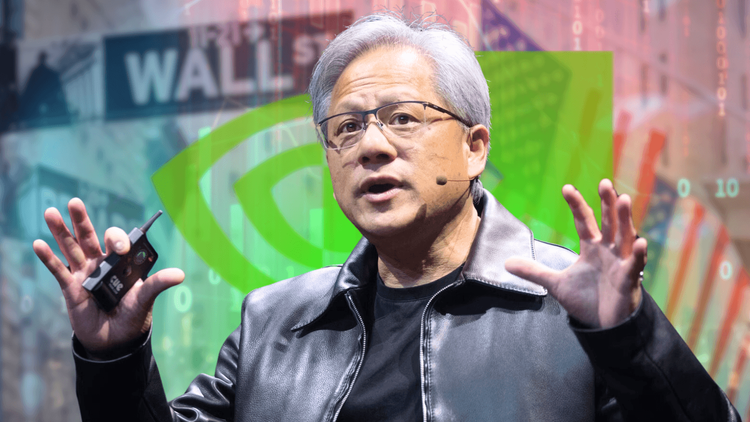

Nvidia Leads Wall Street’s 'Rebound' Picks After Market Downturn

Nvidia poised for a strong rebound as Wall Street analysts predict a recovery in the semiconductor sector by Q4 2024.

Nvidia, a titan in the semiconductor industry, has recently seen its stock take a notable dip, but Wall Street remains divided on whether this downturn is justified or simply a temporary setback. As the debate rages on, Bank of America analyst Vivek Arya has spotlighted Nvidia as a top 'rebound' stock, signaling potential recovery as we head into the latter part of 2024.

The Semiconductor Sector Slump

The semiconductor sector, which has been a cornerstone of technological advancement, has faced significant headwinds in recent months. Nvidia, a leading player in this sector, has seen its stock drop by over 15% in the past month alone. This decline is part of a broader market trend where the PHLX Semiconductor Index has fallen nearly 18% within the same period. The downturn has raised eyebrows among investors and analysts alike, prompting discussions about the sustainability of such a slump.

The reaction from Wall Street has been mixed, with some analysts arguing that the recent slump is overblown, while others remain cautious about the sector's near-term prospects. The rotation by market participants away from large-cap technology stocks, including semiconductors, has fueled this volatility. However, as history has shown, the semiconductor industry often experiences cycles of boom and bust, and the current downturn could be just another phase in this cycle.

Nvidia’s Position in the Market

One of the primary concerns surrounding Nvidia is the delay in the distribution of its next-generation Blackwell chips. These chips, which are integral to Nvidia's AI ambitions, have faced a three-month delay, according to reports. This delay has sparked concerns among Nvidia's major customers, including tech giants like Microsoft, Alphabet, and Meta. The potential impact on Nvidia's revenue and market share has added to the bearish sentiment around the stock.

Despite these challenges, Nvidia remains a dominant force in the semiconductor industry. The company has consistently demonstrated resilience in the face of adversity, maintaining its leadership in the AI and GPU markets. Nvidia's ability to innovate and deliver cutting-edge technology has kept it at the forefront of the industry, even during periods of market turbulence.

Bank of America's 'Rebound' Picks

Vivek Arya, a prominent analyst at Bank of America, has identified Nvidia as one of the top 'rebound' stocks in the semiconductor sector. Arya’s confidence in Nvidia stems from his belief that the current slump is temporary and that the sector is poised for a rebound in Q4 as seasonal headwinds subside. Arya’s analysis also includes Broadcom and KLA Corporation as potential beneficiaries of this anticipated recovery, highlighting their profitability in their respective markets.

The Broader Market Impact

The PHLX Semiconductor Index, a key benchmark for the sector, has mirrored the broader market’s volatility, with a significant decline in recent weeks. This index serves as a barometer for the health of the semiconductor industry, and its recent performance underscores the challenges facing the sector. However, analysts like Arya remain optimistic that the index will recover as the year progresses, driven by a resurgence in demand for semiconductor products.

Large-cap technology stocks have been at the center of the recent market rotation, with investors shifting their focus away from these giants in favor of other sectors. This shift has had a pronounced impact on semiconductor stocks, which are closely tied to the performance of the tech industry. However, the cyclical nature of the tech market suggests that this rotation may be short-lived, and a return to favor for large-cap tech could provide a boost to semiconductor stocks, including Nvidia.

Looking Ahead: Nvidia’s Q4 Expectations

Historically, the semiconductor sector has experienced seasonal trends, with Q4 often marking a period of recovery following summer slumps. Vivek Arya’s analysis aligns with this historical pattern, as he anticipates a rebound in Q4 driven by a reduction in seasonal headwinds. While volatility is expected to persist, particularly around Nvidia’s upcoming earnings release in late August, the long-term outlook for the sector remains positive.

Nvidia's Strategic Moves

In response to concerns about the delay in Blackwell chip distribution, Nvidia has issued a statement reassuring investors that production is on track to ramp up in the second half of the year. Wall Street analysts have largely echoed this sentiment, with many believing that the issue is more about supply chain timing than a fundamental problem with demand. KeyBanc Capital Markets analyst John Vinh, for instance, has expressed confidence that Nvidia will meet or exceed its earnings guidance, further bolstering investor confidence.

Analyst Opinions on Nvidia’s Future

John Vinh, an equity research analyst at KeyBanc Capital Markets, has remained optimistic about Nvidia’s near-term prospects. Vinh argues that the current supply chain challenges are unlikely to impact Nvidia’s earnings significantly and that the demand for Nvidia’s products, particularly in the AI space, remains robust. His outlook suggests that Nvidia is well-positioned to weather the current storm and emerge stronger in the coming quarters.

UBS analyst Timothy Arcuri has also maintained a positive outlook on Nvidia, reiterating his Buy rating on the stock with a price target of $150. Arcuri’s analysis indicates that the delay in Blackwell chip shipments is likely to be minimal, with lead customers expected to receive the chips by April 2025. He also points to the continued growth in AI demand as a bullish indicator for Nvidia’s future earnings, arguing that the market may be underestimating the company’s potential for long-term growth.

The Competitive Landscape

While Nvidia is a leader in the semiconductor space, it faces stiff competition from other giants like AMD, Intel, and Broadcom. Each of these companies has its strengths, but Nvidia’s focus on AI and its ability to innovate have given it a competitive edge. However, staying ahead in this fast-paced industry requires constant adaptation, and Nvidia’s ability to maintain its leadership will be crucial in the coming years.

The demand for AI-driven technologies is expected to be a major growth driver for Nvidia in the coming years. As more industries adopt AI solutions, the need for powerful GPUs and specialized chips will only increase. Nvidia’s strategic investments in AI technology position it well to capitalize on this trend, further solidifying its role as a key player in the global tech landscape.

Investor Sentiment

Despite the recent volatility, many investors remain confident in Nvidia’s long-term prospects. The company’s track record of innovation and its leadership in AI and GPUs have made it a favorite among tech investors. While short-term challenges are inevitable, the overall sentiment suggests that Nvidia’s fundamentals remain strong, and the stock is likely to recover as market conditions stabilize.

Looking ahead, market predictions for Nvidia’s stock vary, but the general consensus among analysts is that the company is well-positioned for future growth. The anticipated rebound in the semiconductor sector, coupled with Nvidia’s strategic initiatives, suggests that the stock could see significant gains in the latter half of 2024 and beyond. Investors will be closely watching Nvidia’s earnings release in August for further guidance on the company’s trajectory.

Conclusion

Nvidia’s recent slump has sparked debate among investors and analysts, but the consensus appears to be that the downturn is temporary. With a strong position in the semiconductor and AI markets, Nvidia is poised for a rebound as we head into Q4. The company’s ability to address supply chain challenges and capitalize on growing demand for AI technology will be key to its future success.

As the semiconductor sector navigates through its current challenges, Nvidia’s resilience and innovation continue to set it apart. While volatility may persist in the near term, the long-term outlook for Nvidia remains positive. Investors who weather the storm could see significant returns as the company continues to lead in one of the most critical industries of the 21st century.