Lithium Stocks Surge as CATL Slashes Production at Chinese Mine

Lithium stocks experience a major rebound as CATL's production halt relieves oversupply concerns, sparking optimism in the global market.

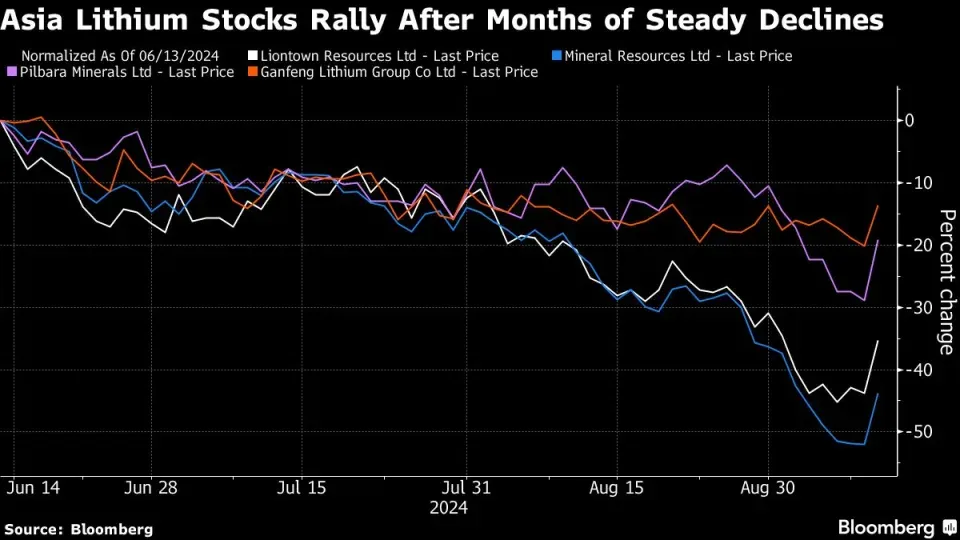

Lithium stocks have recently experienced a remarkable surge as Contemporary Amperex Technology Co. Ltd (CATL), a global leader in battery manufacturing, adjusted output at one of its key mines. The production halt at CATL’s lithium lepidolite operation in Jiangxi, China, has sent ripples through the industry, easing oversupply fears and fueling a rally among lithium producers. Shares of some of the biggest names in lithium mining, including Albemarle Corp., Pilbara Minerals Ltd., and Tianqi Lithium Corp., have surged, with gains reaching up to 17%. This sudden market activity highlights the critical role that lithium plays in the battery industry and how sensitive the market is to shifts in supply dynamics.

The Rise of Lithium Miner Stocks

As the world’s largest lithium miner, Albemarle Corp. was one of the biggest beneficiaries of CATL’s production cut. Shares of Albemarle soared by as much as 17% in New York, driven by investor confidence that the production halt would help rebalance the lithium market. Albemarle’s stock had languished earlier in the year due to oversupply concerns and falling demand for lithium as the electric vehicle (EV) market experienced slower-than-expected growth.

Lithium stocks across the globe responded positively to the news. Pilbara Minerals Ltd., a significant player in the Australian lithium sector, saw its shares rise by 17%, while Tianqi Lithium Corp. experienced a 16% surge in Hong Kong. This rally extended to other key producers, such as SQM, which gained 12%. Investors are banking on CATL’s production cut to alleviate the oversupply that has plagued the market for much of 2024.

CATL’s Role in the Lithium Market

Contemporary Amperex Technology Co. Ltd (CATL) holds a dominant position in the global battery supply chain. As the largest producer of batteries for electric vehicles, CATL’s decisions on raw material sourcing and production have wide-reaching implications. With its operations stretching across Asia and partnerships with major EV manufacturers, CATL plays a pivotal role in setting trends in the lithium market.

The company’s recent decision to halt lithium lepidolite production at its Jiangxi mine marks a significant shift. According to UBS Group AG, this move will reduce China’s monthly lithium carbonate output by 8%. While this is not the first time rumors have surfaced about halted production at the mine, UBS analysts have expressed a higher level of conviction that this time the news is accurate, predicting it will help rebalance the market.

Supply Chain Disruption and its Impact

Lithium carbonate is a critical component in the production of batteries for electric vehicles. China is the world’s leading producer of this essential material, and any disruption in production has far-reaching consequences. The 8% reduction in output is expected to have a noticeable impact on global supply, especially in light of the oversupply issues that have driven prices down throughout 2024.

The global lithium market is interconnected, with demand for batteries rising from Europe to the Americas. The cut in production from China could tighten supply chains and drive up prices in other regions. Lithium stocks, which typically rise six to nine months ahead of commodity prices, are already responding to this expected tightening of supply.

Market Reaction to CATL’s Announcement

Investors have reacted swiftly to CATL’s announcement, with lithium miner stocks enjoying one of their best days in recent memory. The production halt at the Jiangxi mine has provided a much-needed boost for lithium producers, many of whom have been struggling with falling prices and slowing demand from the EV sector.

UBS analysts, led by Sky Han, expect lithium prices to rise between 11% and 23% by the end of 2024, driven by reduced supply from China and improving demand from battery manufacturers. The brokerage also highlighted that past rumors about halted production at the Jiangxi mine had turned out to be false, but this time there is “higher conviction” in the reliability of the information.

Lithium Market Trends in 2024

Throughout 2024, the lithium market has struggled with an oversupply that has weighed heavily on prices. While demand for batteries continues to grow, it has not kept pace with the rapid expansion of lithium production, particularly in China. This mismatch between supply and demand has led to significant price declines and forced some producers to scale back operations.

The slowdown in EV sales has been another contributing factor to the lithium market slump. Despite strong government incentives and the global push for electrification, EV sales have fallen short of expectations in key markets, including Europe and the United States. This has reduced the demand for lithium, further exacerbating the oversupply issue.

Global Lithium Projects Facing Challenges

In Australia, several lithium producers have been forced to take drastic measures in response to falling prices. Arcadium Lithium Plc and Core Lithium Ltd. were among the companies that shuttered high-cost sites, while Global Lithium Resources Ltd. announced plans to cut expenses immediately, citing a longer-than-expected slump in pricing.

Global Lithium Resources Ltd. has taken proactive steps to reduce its operational costs in light of the challenging market conditions. The company’s decision to cut expenses at its promising project underscores the difficulties faced by even the most prospective lithium developers in the current environment.

Lithium Prices and Market Outlook

Despite the current challenges, there is optimism on the horizon for lithium prices. UBS analysts predict that prices could rise significantly in the coming months, thanks to the reduction in supply from China and a potential rebound in demand from battery manufacturers. This could mark the beginning of a new upcycle for lithium, with prices expected to start rising as early as 2026.

One of the key factors contributing to the expected price rise is the slowdown in capital expenditure across several major lithium projects. In Argentina, for instance, construction delays at the Sal de Vida project have pushed back production timelines, while capital expenditure at other sites has also been cut. This tightening of supply is likely to support higher prices in the future.

Albemarle’s Strategic Moves Amidst the Price Decline

Albemarle Corp. has taken decisive action in response to the falling lithium prices by shutting down half of its processing capacity in Australia and putting expansion plans on hold. This move reflects the company’s cautious approach to managing its production in the face of a challenging market environment.

Albemarle’s decision to cut production will have ripple effects across the global lithium supply chain. As one of the largest producers in the world, Albemarle’s reduction in output could further tighten supply and support a potential price rebound in the coming years.

The Broader Impact of CATL’s Output Adjustments

CATL’s decision to halt production at its Jiangxi mine has provided a glimmer of hope for the lithium market. By reducing oversupply, the company is helping to stabilize prices and restore balance to the market. This move is likely to benefit not only lithium producers but also investors who have been waiting for a turnaround in the sector.

While the immediate impact of CATL’s output adjustment is positive, the long-term dynamics of the lithium market remain complex. As demand for electric vehicles continues to grow and new technologies emerge, the balance between supply and demand will be crucial in determining the future trajectory of lithium prices.

Conclusion

The recent surge in lithium miner stocks following CATL’s production halt highlights the sensitivity of the market to supply disruptions. While the lithium industry has faced significant challenges in 2024, there is optimism that reduced output from key players like CATL will help rebalance the market and support a potential price rebound. Investors and producers alike will be closely monitoring the situation as the year progresses.