Diving for Dollars: TMC’s $37M Ocean Mineral Adventure

TMC’s $37M Boost Signals Bright Future for Deep-Sea Mining and U.S. Mineral Security

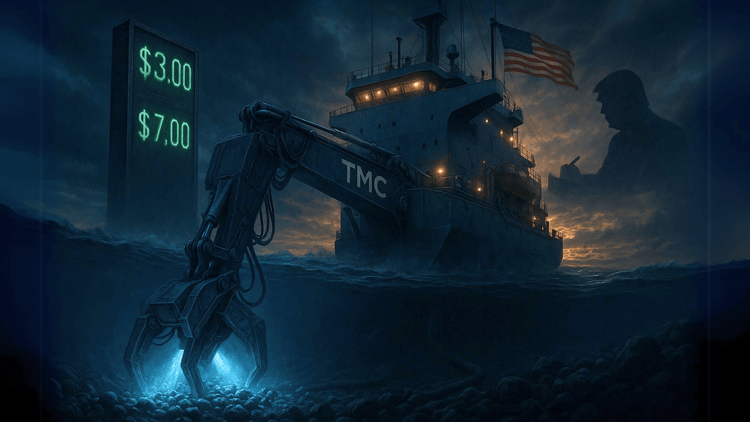

In a seismic move for the deep-sea mining frontier, TMC the metals company Inc. (Nasdaq: TMC) has clinched a $37 million strategic investment, cementing its role as a trailblazer in the race for critical minerals. Announced on May 12, 2025, this Registered Direct Offering, priced at $3.00 per share, is led by two titans of resource investment: Michael Hess, Chief Investment Officer of Hess Capital, and Brian Paes-Braga, Managing Partner at SAF Group and Head of SAF Growth. With warrants exercisable at $4.50 per share—and a kicker that mandates exercise if shares soar above $7.00 for 20 consecutive days—this deal is as bold as it is calculated.

Heavyweight Backing for a High-Stakes Mission

Michael Hess and Brian Paes-Braga aren’t just writing checks; they’re bringing a treasure trove of expertise and connections to TMC’s table. Hess, a 15-year veteran of exploration and production, and Paes-Braga, a master of large-scale resource deals, share a vision of bolstering America’s mineral independence. “We’ve been scouring the critical minerals landscape for opportunities that align with national interests,” Hess said. “TMC’s unique position in ocean minerals makes it a linchpin for advancing U.S. resource security.”

This isn’t just about money—it’s about momentum. The $37 million, raised through 12.3 million common shares paired with Class C warrants, is expected to fuel TMC’s operations through the anticipated issuance of a commercial recovery permit. With a closing date slated for May 22, 2025, pending standard conditions, TMC is poised to charge toward its commercial ambitions with newfound firepower.

Riding the Regulatory Wave

The timing couldn’t be sharper. On April 24, 2025, President Donald Trump issued an Executive Order to fast-track seabed mining, promising expedited permitting and potential federal investment. TMC didn’t miss a beat, submitting the world’s first commercial recovery application for polymetallic nodules in international waters on May 1—over two months ahead of schedule. This regulatory tailwind, paired with Hess and Paes-Braga’s strategic clout, positions TMC to capitalize on a once-in-a-generation opportunity.

Gerard Barron, TMC’s Chairman and CEO, isn’t holding back his enthusiasm. “Michael Hess’s involvement is a game-changer,” Barron said. “His deep experience and relationships across U.S. industry and government amplify our vision of delivering critical metals with minimal impact.” Barron’s optimism is rooted in TMC’s mission to harvest seafloor polymetallic nodules, a lower-impact source of metals vital for energy, defense, and infrastructure.