Central banks made super-rich richer

Striking development during the pandemic

Almost 500 people have become billionaires over the course of the pandemic. Stock markets have risen steadily, while unemployment has risen and real wages have stagnated. Somehow, house prices, which many believed would finally fall as economic activity slowed, have remained stable.

On the surface, the exuberance in asset markets makes little sense. Asset prices are designed to reflect expectations of future returns, whether in the form of dividends, imputed rents, interest or capital gains. The slowdown in economic activity coupled with rising consumer prices should have prompted investors to adjust their expectations for variables such as future earnings. The reason this adjustment didn't happen was because central banks didn't allow it.

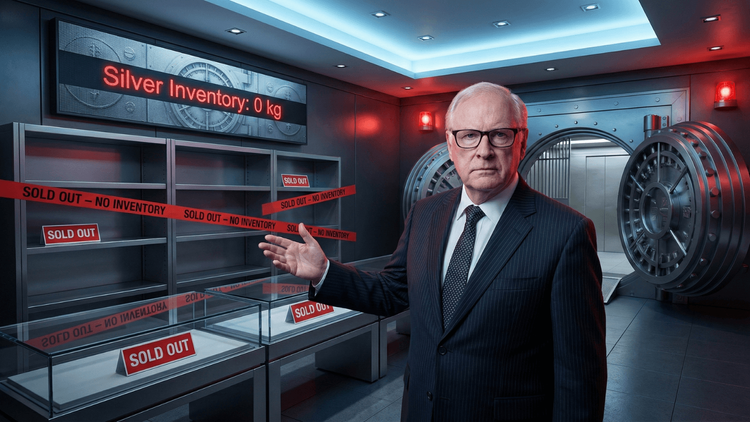

They responded to the initial panic in financial markets by creating trillions of dollars worth of new money and using it to buy private sector assets. These interventions left investors inundated with cash and a lack of safe haven assets - naturally, they sought higher returns by dumping that money into riskier assets such as tech and healthcare stocks, dubious corporate bonds, and even cryptocurrencies and NFTs.

The resulting boom in asset markets around the world has made those who hold those assets extremely wealthy, giving the super-rich a tremendous boon and some breathing space for middle-class homeowners with retirement funds. In the UK, the wealthiest 1% of households have more financial wealth than the bottom 80% of the population. In the United States, the richest 1 percent own 80 percent of the country's stocks.

Nevertheless, it is difficult to determine the impact of these measures, as wealth inequality is notoriously difficult to measure. In the UK, we rely on the Office for National Statistics (ONS) Wealth and Assets Survey (WAS), which is self-reported.

The collection takes a long time, so the data are published relatively infrequently and with a considerable delay. (The data released today relates to a survey conducted between April 2018 and March 2020, making it useless for understanding the impact of the pandemic on wealth inequality.) Using survey data also makes the data less reliable -- the wealthiest consistently understate the extent of their wealth, at least in part because wealthy individuals have a greater incentive and ability to hide their wealth to avoid taxes.

Comparing WAS data to sources like the Sunday Times Rich List or the Forbes Billionaire List provides a much deeper insight into the wealth of the top 1 percent - perhaps because the wealthy are more honest with sources unaffiliated with the state are; or maybe just out of a vain desire to get as close to the top of the list as possible. In any case, using these data sources, social scientists have concluded that the official surveys underestimate the wealth of the top 1 percent by at least 6 percentage points. Even so, the extent of wealth inequality in the UK is likely to be underestimated.

When consulting these statistics, we must always keep in mind that the dramatic increase in the wealth of top executives is by no means the "natural" result of the free market. It was brought about by the political decision-makers.

Rising wealth inequality is now built into the workings of the UK economy, with conflicting results. If asset prices fell drastically, the millions of people who rely on the value of their home or their pension fund to fund their retirement would be left to rely on the UK's state pension - the least generous in the developed world. In response, they would stop spending and maybe even start selling their assets, adding to the problem.

The problem, of course, is that if asset prices are not allowed to fall, the economy cannot "recover" as it normally would after a pandemic-scale crisis. New homeowners will not climb the real estate ladder, and many will end up spending a large portion of their income paying rent to retirees, pushing them into debt and constraining consumer spending. Bankrupt companies will not be subject to the Schumpeterian forces of creative destruction. Instead, the largest and most powerful companies will be able to use cheap money to buy out their competitors and consolidate their market power.

The wealthy, on the other hand, will have more money than they can use. So they will continue to pour their excess money into the financial markets to be turned into debt for powerful corporations and less affluent people. The end result is an economy akin to a debt bondage system - only on a planetary scale. A study from the United States has shown that the wealthy have now "accumulated substantial financial assets representing direct claims on US government and household debt". Most of what we owe we owe to the top 1 percent.

The level of inequality we must confront defies reformism. The forces that are sucking wealth to the top of the economy are now so powerful that they seem almost unstoppable. But, as David Graeber once wrote, "the ultimate, hidden truth of the world is that it's something we do, and we might as well do it differently". This point is clearer than ever in the face of a pandemic determined not by the abstract economic forces of the "free market" but by political interventions by states, powerful corporations and financial institutions.

These interventions have shown more clearly than ever that wealth inequality is not a single economic problem that can be solved with technocratic measures. It's a matter of power and politics. Whoever controls the institutions that distribute wealth in the global economy determines who gets what.