The Trifecta of Antimony: Military Metals' Global Strategy

Military Metals unlocks the potential of past-producing antimony assets across Nevada, Nova Scotia, and Slovakia to tackle global critical mineral supply chain challenges.

In a rapidly shifting geopolitical landscape, where mineral supply chains are under intense scrutiny, Military Metals Corp. (CSE: MILI | OTC: MILIF) is emerging as a pioneer. Focused on revitalizing past-producing antimony mines, the company has secured strategic assets across North America and Europe, building what can only be described as a "Trifecta of Antimony." This bold approach positions Military Metals to mitigate global supply risks for this essential mineral, deemed critical by governments worldwide.

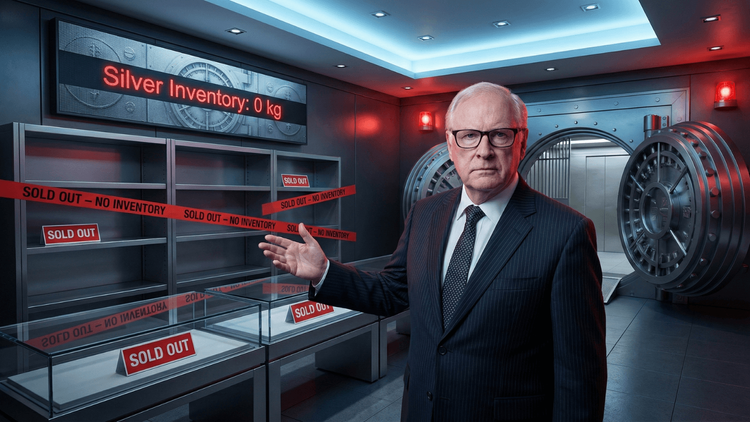

Why Antimony Matters: A Critical Mineral in Crisis

Antimony, essential for flame retardants, semiconductors, batteries, and advanced military applications, is underpinned by escalating geopolitical pressures. Over 90% of global reserves are concentrated in China, Russia, and Tajikistan. This monopoly, coupled with rising demand, has sent prices soaring, from $11,000 to $34,000 per tonne. Military Metals’ CEO, Scott Eldridge, notes: "The West faces unprecedented challenges in securing antimony. Our acquisitions are designed to counterbalance the global reliance on China and build a self-sufficient future for critical materials."

The Trifecta of Antimony Assets

1. Last Chance Antimony-Gold Property, Nevada

Military Metals recently announced an LOI to acquire the historic Last Chance Antimony-Gold Property in Nye County, Nevada. Located just 18 kilometers from the prolific Round Mountain Gold Mine, this project boasts a rich history of antimony production dating back to the early 20th century.

Key Highlights:

- Strategically located near established mining infrastructure.

- Contains structurally controlled antimony in quartz veins, along with gold mineralization.

- Acquisition cost includes $45,000 USD and a 2% Net Smelter Royalty.

Eldridge elaborated: "Last Chance represents a bridge between the past and future. We’re leveraging its rich history to develop a cornerstone North American supply of antimony."

2. West Gore Antimony Project, Nova Scotia

The West Gore Antimony Project in Nova Scotia reflects Military Metals’ commitment to revitalizing historical resources in stable jurisdictions. This Canadian asset, with a legacy of antimony and gold production, aligns perfectly with the company’s strategy.

Key Highlights:

- Historically significant for antimony mining in Canada.

- Positioned in a politically stable region, ensuring long-term viability.

Eldridge emphasizes the importance of this acquisition: "West Gore is more than a project; it’s an opportunity to redefine what’s possible in domestic mineral development."

3. European Antimony and Tin Projects, Slovakia

Military Metals’ European venture is anchored in Slovakia, home to three brownfield projects, including the Trojarova Antimony Deposit. Described as one of the European Union's most significant known antimony resources, this acquisition signals a transformative step for the company.

Key Highlights:

- Trojarova Project: 1.5 kilometers of strike, 63 historic drill holes, and 1.7 kilometers of underground workings.

- Tiennesgrund Antimony Property: 10-kilometer-long fault-hosted vein system with artisanal-scale production history.

- Medvedi-Potok Tin Property: Features a classic tin vein system with underground workings and a historic (non-compliant) resource.

Eldridge asserts: "Trojarova could be a game-changer for Europe. With the EU’s Critical Raw Materials Act fostering development, we’re well-positioned to address Europe’s antimony needs."

Strategic Value of Past-Producing Mines

Military Metals’ emphasis on past-producing mines is a masterstroke. These sites offer:

- Existing Infrastructure: Minimizing development costs.

- Proven Mineralization: Reducing exploration risk.

- Historical Data: Accelerating resource verification and compliance.

"We’re building on proven foundations," Eldridge said. "This allows us to focus on scalability and sustainability in delivering critical minerals to the market."

Tackling Geopolitical Challenges

As trade wars and supply chain disruptions intensify, the need for domestic and allied critical mineral sources is more urgent than ever. Military Metals’ diversified portfolio directly addresses these challenges, ensuring secure, long-term access to antimony for the West.

"This isn’t just about mining," said Eldridge. "It’s about securing a strategic advantage in the global race for critical resources."

Conclusion

Military Metals is leading the charge in addressing the critical mineral crisis with its Trifecta of Antimony—strategically revitalizing past-producing assets in Nevada, Nova Scotia, and Slovakia. Under CEO Scott Eldridge’s visionary leadership, the company is poised to redefine the antimony supply chain, bridging the gap between geopolitical necessity and resource sustainability.

With its bold strategy and global reach, Military Metals is not just a player in the market; it’s a force reshaping the future of critical mineral supply.