Soy Long, China: Trump Turns Up the Heat in the Trade Kitchen

Soybean fields meet global politics as Trump fires back at China’s crop boycott—turning America’s heartland into the latest front in the trade war.

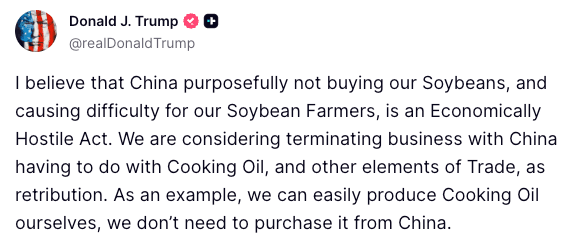

In the heartland's amber waves of grain, where soybeans reign as the unsung hero of American exports, a familiar storm is brewing. President Donald Trump has fired off a bold declaration, labeling China's abrupt halt on U.S. soybean purchases an "economically hostile act" and hinting at retaliation through severed ties on cooking oil and beyond. It's a punchy escalation in a trade war that's already left Midwestern farmers nursing wounds deeper than a bad harvest, with storage bins overflowing and prices plummeting like a combine in neutral. As of October 2025, this isn't just rhetoric—it's a high-stakes poker game where the chips are bushels, and the pot includes billions in lost revenue.

Let's cut through the chaff: China, the world's voracious soybean vacuum cleaner, snapped up over half of U.S. exports in recent years, funneling some $12.6 billion into farm coffers annually. But since May, they've gone radio silent, zeroing out purchases in retaliation for Trump's tariffs on Chinese goods—starting at 10% in February and climbing to an average 55% by summer. The result? U.S. soybean exports to Beijing plunged 51% through July compared to last year, with overall ag shipments down a gut-wrenching 53% in the first seven months of 2025. Farmers in powerhouse states like Illinois, Iowa, Minnesota, and North Dakota are staring at a $10 billion to $15 billion hole this season, per USDA tallies and American Soybean Association estimates. One North Dakota operation, a 76-year-old family spread spanning 2,300 acres, is projecting a $400,000 shortfall alone—enough to make even the sturdiest silo weep.

The math tells a stark tale. Pre-trade war, China guzzled 60% of America's soybean bounty, turning those golden pods into feed for its massive hog herds and beyond. Now, with Beijing's 20% retaliatory levy making U.S. beans pricier than a Beltway steak, they've pivoted hard to Brazil and Argentina, ramping imports there by 25% to 30%. U.S. futures for the November contract have skidded to around $9.85 per bushel, a $0.74 to $2 drop that erodes profits faster than drought. "We're being used as a bargaining chip in a fight that's not ours," laments Caleb Ragland, president of the American Soybean Association, echoing the desperation rippling through rural America. Storage woes compound the crisis: Grain elevators are balking at accepting more beans without export outlets, risking a logjam that could idle combines and spike foreclosures. Farm bankruptcies, already up 55% last year, are trending higher, with experts warning of a "trade and financial precipice" if no deal materializes by November.