Silver's Rising Importance: A Call for Critical Mineral Status

The Silver Industry's Plea for Critical Mineral Recognition

In a bold move, top silver producers are advocating for silver to be recognized as a critical mineral in both Canada and the United States. The CEOs of 19 prominent mining companies, including industry giants like Coeur Mining, Hecla Mining, and First Majestic Silver, have jointly penned a compelling letter addressed to the Canadian Minister of Energy and Natural Resources, Jonathan Wilkinson. Their message is clear: Designating silver as a critical mineral would position the countries as preferred suppliers for strategic allies in an era where sustainable and advanced technologies are gaining paramount importance.

A Timely Initiative

This initiative comes hot on the heels of a significant development in December 2023 when Natural Resources Canada opened a public commentary period to solicit input on proposed updates to Canada's Critical Minerals list and methodology. One of the central criteria for a mineral to earn this classification is its indispensable role in facilitating the national transition toward a "low carbon and digital economy."

Silver's Remarkable Qualities

The CEOs' letter underscores the unique attributes that make silver indispensable. Silver stands out as the best electrical conductor, the most efficient metallic thermal conductor, and the ultimate reflective material among metals. These exceptional properties position silver as an essential and irreplaceable component in numerous industrial and technological applications.

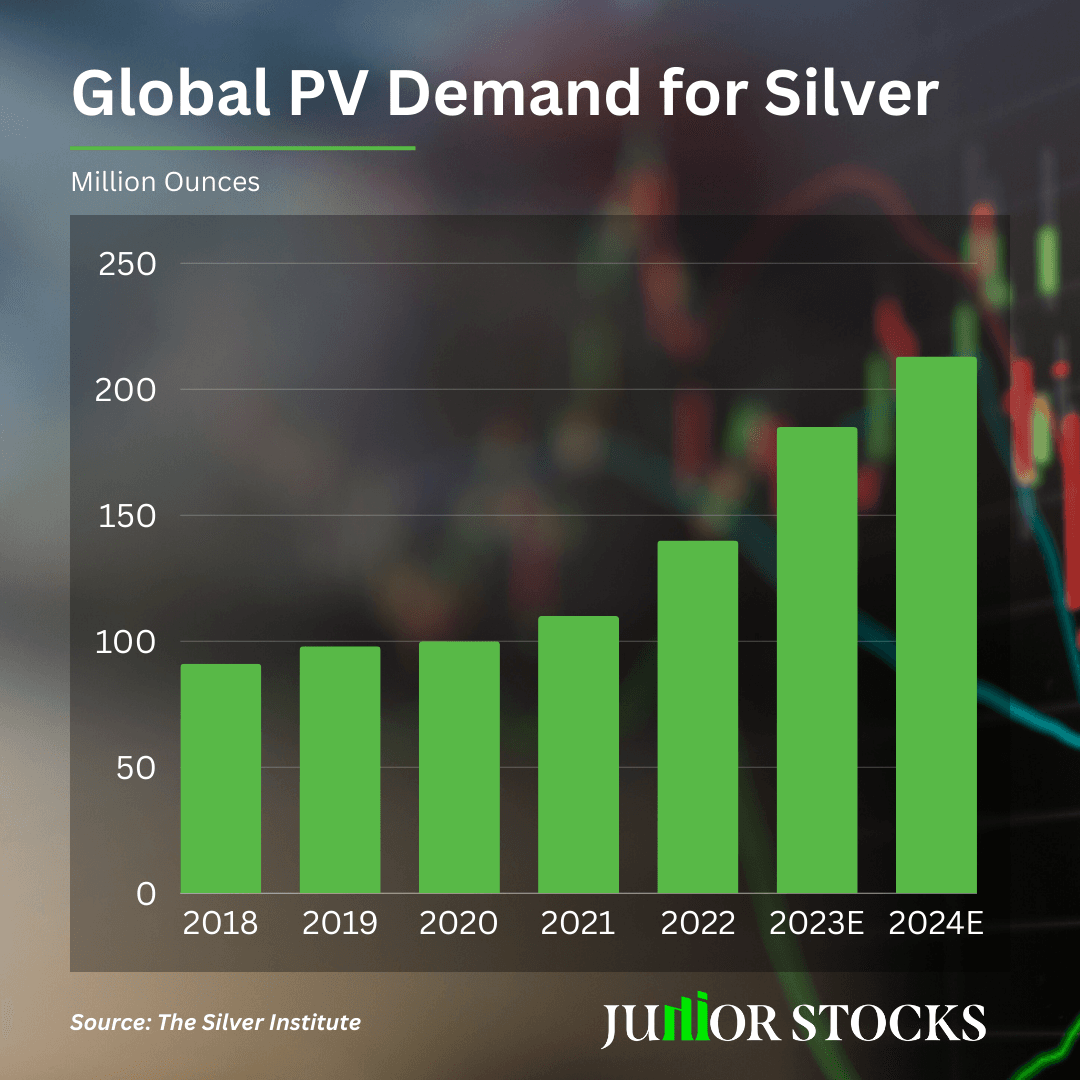

Soaring Industrial Demand

The rising adoption of technologies such as solar power has led to an unprecedented surge in industrial demand for silver. In 2023 alone, global silver demand reached a staggering 1,167 million ounces (Moz). Astonishingly, industrial usage accounted for a significant portion, with 576.4Moz, or 50%, of the total demand. Photovoltaics alone accounted for 161.1 Moz in 2023, making up 14% of the global silver demand.

Silver's Role in Nuclear Energy

Silver's versatility extends to its role in nuclear reactors, and this is gaining prominence as well. The mining CEOs aptly point out that with Canada joining other nations at COP28 to commit to tripling nuclear energy capacity by 2050, the demand for silver in nuclear applications is poised to witness substantial growth.

Automotive Industry's Electrification

The automotive industry is also set to drive up silver demand as fleets increasingly transition toward electrification. Silver is a crucial component in electric contacts and connectors used in electric vehicles (EVs) and hybrids. This shift towards cleaner transportation solutions is expected to further boost the demand for silver.

Dispelling Misconceptions

One of the primary challenges that silver faces in securing its critical mineral status is a misconception about its availability. The CEOs emphasize that this misconception has arisen due to the perception of silver as a readily accessible and budget-friendly precious metal. However, researchers worldwide have raised alarm bells, highlighting silver's potential to become a bottleneck in the transition to a low-carbon economy due to supply limitations, disruptions in supply chains, competition for other uses, and increasing demand.

A Promising Future

A new list of critical minerals for Canada is anticipated to be published before the summer of 2024. Jillian Lennartz, Director of ESG for First Majestic Silver, has also disclosed that they've submitted written queries regarding the methodology used by the U.S. Geological Survey. These queries express concerns about the USGS's methodology for compiling its critical minerals list and offer suggestions for improvement.

Industry Unites

The National Mining Association and the Silver Institute have also joined forces in the endeavor, sending a compelling letter to the Department of Energy (DOE) in October of the previous year. Their argument revolves around the inadequacy of silver reserves to meet projected demand and the unlikelihood of silver recycling being a substantial source.

Awaiting Evaluation

When questioned about the possibility of silver's inclusion, a source at the USGS stated that all minerals under consideration for the 2025 list are currently undergoing rigorous evaluation based on specific formulas. The list and methodology are expected to be officially released in the federal register later this year.

In conclusion, the rallying cry from top silver producers underscores the pivotal role of silver in the emerging low-carbon and digital economy. Their collective efforts, supported by industry associations and organizations, may very well reshape the perception of silver from a common precious metal to a critical mineral essential for the sustainable future we are all striving to achieve.